On Banks

A key development during the first quarter was the failure of several large U.S. banks, including Silicon Valley Bank (SVB) and Signature Bank, and the subsequent scrutiny on the U.S. banking system. In addition to the bank failures in the U.S., UBS agreed to purchase Credit Suisse, furthering concerns over the banking system. Ultimately, the U.S. saw the second and third largest bank failures in the country’s history.

One of the biggest issues with SVB was what is known as an “asset-liability mismatch”. Bank deposits are an asset of the depositor and a liability of the bank. Banks will often take those deposits and invest them, either by making loans to customers, or purchasing bonds that are generally considered to be safe from a credit risk perspective. The low interest rate environment of the last several years led some banks to “reach for yield” and buy longer dated bonds to earn higher (though still low at the time) yields. As interest rates increased over the past three years, the value of those bonds declined. If, as was the case with SVB, sufficient deposits are withdrawn from a bank (i.e., the loans to the bank are called), the bank may be forced to sell bonds in their portfolio at losses. If the magnitude of withdrawals and the portfolio losses together are large enough, this may cause a bank failure.

SVB was unique in that their depositors consisted of early-stage companies with high cash burn rates, rather than traditional (sticky) depositors such as households. This uncommon structure created a situation in which over 80% of SVB’s depositors had balances above the $250,000 FDIC insurance limit. The bank saw their deposits triple from early 2020 through the end of 2021 as their customer base thrived in the pandemic era. High growth tech companies saw valuations surge and IPO activity was robust. Over the last 15 months, the winners of the pandemic era lagged as interest rates surged and the market began to reward profitability rather than growth. Cash was withdrawn almost as quickly as it was accumulated as depositors burned through cash. By the time the bank failed on March 10, the trickle had turned into a flood with clients withdrawing approximately 81% of the deposits held at the end of 2022.

Over the past month we have had many conversations with clients regarding asset safety. It is our view that, at this time, assets custodied with Schwab and Fidelity are not at risk for the type of failure seen at SVB.

It remains to be seen how pervasive problems caused by the decline in bond prices will be across banks, but generally we do not see this turning into a 2008-like crisis where even institutions with reasonable risk management are exposed to unforeseen risk through counterparty relationships with other troubled financial institutions. Further, in the case of the banks that failed recently, the government stepped in to protect depositors. Additionally, in response to SVB’s collapse, the government has set up a Bank Term Funding Program (BTTP) facility to offer loans to banks in exchange for high quality collateral (such as U.S. treasury bonds) whereby that collateral is valued at par (face value) rather than market value for purposes of the loan. We believe these steps are reasonable and provide fortification to the banking system.

Clients may be asking what this means for them. First and foremost, we believe it is prudent for clients to confirm that their cash sitting in bank accounts is insured. As a reminder, banks typically offer FDIC insurance up to $250,000 per insured bank per account holder. If clients have uninsured deposits at banks, there are a number of potential alternatives with varying levels of risk. Banks have been slow to raise yields on deposits and we’ve found that U.S. treasury bonds and money market funds offer compelling yields for cash. If you have questions about potential options, please reach out to us.

Additionally, we continue to carefully monitor developments within the banking system and the economy broadly. The Fed has aggressively raised rates over the last 12 months as they’ve tried to slow inflation and the economy. SVB was a bit of a perfect storm that is an outlier within the U.S. banking system. However, it is likely that we will see additional cracks in the economy as we navigate the latter stages of this Fed tightening cycle.

https://www.fdic.gov/resources/deposit-insurance/brochures/deposits-at-a-glance/

https://www.fdic.gov/resources/deposit-insurance/faq/

Market Commentary

Bank troubles aside, 2023 started off with a bit of reprieve from the pain of 2022. Nearly every major asset class was positive for the quarter, with developed market international stocks leading the way, up 8.5%. In the U.S., the S&P 500 returned 7.5%. Smaller companies underperformed, with the Russell 2000 returning 2.7%.

While the quarter was volatile, the Bloomberg Aggregate Bond Index was up 3%. Despite the Fed continuing to increase the fed funds rate, interest rates declined modestly for most maturities as markets quickly priced out additional rate hikes later this year and began to price in rate cuts later in 2023 and into 2024.

After being nearly the only place to hide in 2022, commodities gave up half of their 2022 gains in the first quarter, with the index dropping 5.4%.

Economic Outlook

All eyes continue to focus on the Fed. After the bank failures mentioned above, the market began debating to what extent the Fed would forgo additional monetary tightening with the goal of alleviating financial strain caused by the banking system. Prior to the collapse of SVB, the market was pricing in some chance of a 0.5% increase in the fed funds target rate during the March meeting. That probability was quickly erased and the market was then split between a 0.25% increase and no change. Possibly to avoid panic created by signaling the banking system was no longer strong enough to hike interest rates, the Fed ultimately increased their target rate 0.25%. It seems likely that at least in absolute terms (as opposed to time period), the Fed is closer to the end of their hiking cycle than the beginning.

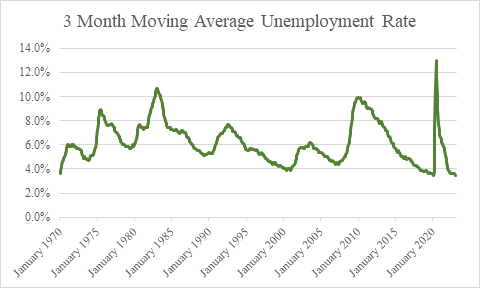

Once the Fed believes they have finished hiking interest rates, it’s unclear how long they will leave their target rate at the then-prevailing rate. However, the shape of the yield curve and futures markets indicate that the Fed will be finished hiking by May of 2024. Presumably, future rate cuts will be attributable to inflation falling closer to the Fed’s target (this is unlikely in the short-term) or unemployment increasing. With the latter being most likely, this suggests the market is pricing in some sort of recession in the next year. That said, the three-month moving average unemployment rate (a measure that we monitor closely for potential signs of recession) is at the lowest level since the Great Financial Crisis in 2008. However, we did see the unemployment rate tick up in February from 3.4% (the lowest level in over 50 years) to 3.6%. We would need to see a meaningful deterioration in the labor market to enter a significant recession. Most other recession indicators we watch are also in reasonably healthy territory, with the exception of industrial production, which may have peaked in September 2022. Until the banking failures, it would have been fair to characterize the economy as quite resilient despite the dramatic policy tightening. We remain in the camp that probability of recession remains elevated, but the likelihood of a severe recession is smaller than that of a relatively mild one.

Source: U.S. Bureau of Labor Statistics, Unemployment Rate [UNRATE], retrieved from FRED, Federal Reserve Bank of St. Louis; https://fred.stlouisfed.org/series/UNRATE, April 4, 2023.

We remain watchful for signs of recession as outlined above. With economic data holding up reasonably well, and pervasive negative sentiment, we are hesitant to reduce risk at current valuations. Earnings expectations over the next twelve months are close to where they began 2022. Profit margins are well off their highs. Earnings growth expectations are well below their 20-year average. These points generally suggest that at least some of the negative sentiment is priced into stocks, and thus investors would not benefit from moving below neutral allocations to stocks in response to these forecasts.

Within stocks, we made minor adjustments from U.S. large cap stocks to small cap growth stocks during the quarter. At the end of 2021, small cap growth traded at about 1.2 times its 20-year average price-to-earnings ratio. By the end of 2022, it traded at about 0.7 times its 20-year average P/E. This swing led us to fill out our allocation to this part of the market where possible.

High quality intermediate-term bond positions remain attractive in our view despite strong returns in the first quarter. Volatility in the bond market may remain unusually elevated as market expectations are seemingly re-priced with every release of economic data.

Client portfolios remain broadly diversified as we prepare for a wide variety of market outcomes made possible by the Fed, banking sector, and companies’ ability to deliver on earnings expectations. This remains a time to be disciplined in our view – not a time for panic or for excess risk taking. As always, please reach out to us if you would like to discuss your portfolio.

Important Disclosure Information

Please remember that past performance may not be indicative of future results. Different types of investments involve varying degrees of risk, and there can be no assurance that the future performance of any specific investment, investment strategy, or product (including the investments and/or investment strategies recommended or undertaken by The Financial Advisory Group, Inc. (“The Financial Advisory Group”), or any non-investment related content, made reference to directly or indirectly in this commentary will be profitable, equal any corresponding indicated historical performance level(s), be suitable for your portfolio or individual situation, or prove successful. Due to various factors, including changing market conditions and/or applicable laws, the content may no longer be reflective of current opinions or positions. Moreover, you should not assume that any discussion or information contained in this commentary serves as the receipt of, or as a substitute for, personalized investment advice from The Financial Advisory Group. Please remember to contact The Financial Advisory Group, in writing, if there are any changes in your personal/financial situation or investment objectives for the purpose of reviewing/evaluating/revising our previous recommendations and/or services, or if you would like to impose, add, or to modify any reasonable restrictions to our investment advisory services. The Financial Advisory Group is neither a law firm, nor a certified public accounting firm, and no portion of the commentary content should be construed as legal or accounting advice. A copy of The Financial Advisory Group’s current written disclosure Brochure discussing our advisory services and fees continues to remain available upon request or at www.finadvisors.com.